How We Do Our Budget

It’s the beginning of the month which means it’s budget time! Part of being on Dave Ramsey’s program means we do a budget every month. We have a “Budget Committee Meeting” during the last weekend of the month in which we put together next month’s budget and talk about our financial goals.

Before taking Dave Ramsey’s Financial Peace class, I always thought a budget meant you write down what you’d like to spend, and it would be the same budget every month; little did I know I was setting myself up to fail.

Dave Ramsey teaches doing a fresh budget every month because no two months are exactly the same. Sure you may have a handful of expenses that remain the same like utilities, rent, etc. but some months you may be budgeting for one thing and then the next month not so much. For example, we’ll be budgeting extra this month for Christmas shopping, something we don’t necessarily need to do every month.

Why do a budget? We’re telling our money where to go. Budgeting is about giving every dollar a purpose.

It helps keep us on the same page and lessens stress which equals a very happy marriage, haha!

We do a zero-based budget in which we start with the total amount of money we anticipate bringing home for the month and by assigning every dollar to something we end with a total of zero.

Paper or Digital

When we first started budgeting we used two forms:

We’d sit down together, fill them both out and keep it in our financial binder.

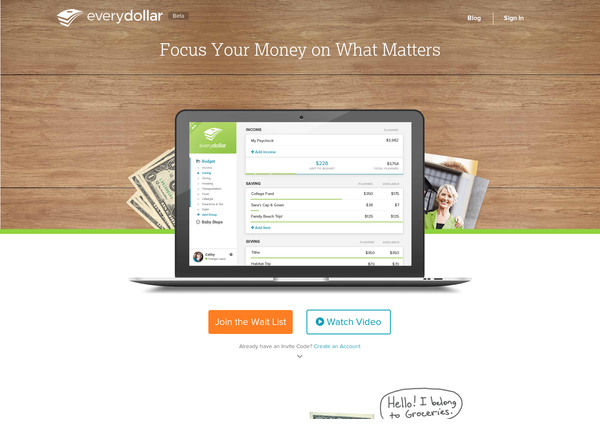

Now we use EveryDollar which is a super handy tool that not only makes setting up your budget a breeze but also makes it easy to keep track of spending throughout the month. It also helps you keep track of your baby steps.

Doing the Budget

1. Figure out how much money we’ll be bringing in for the month.

This is our total take home pay after taxes. It includes both our incomes plus any extra money that comes in. My income is always the same, but Joshua’s varies because he’s flat-rate; he’ll take his average for the past 3-6 months. This total number tells us how much money we have to spend for the month.

We use the Irregular Income form so if Joshua brings in more than we originally budgeted for, we’re able to assign that extra money to other things. It’s kind of like a wish list. I have one gal in my small group that calls it her “miracle money.”

2. Put in all of our monthly expenses.

I look at this step as things that have to be paid no matter what. Things that come before lifestyle expenses. For us it includes utilities, insurance, mortgage, groceries, transportation, and giving. We punch those into our budget first before anything else.

Things like utilities, insurance and our mortgage are easy because those stay relatively the same each month. We have a couple utilities like garbage and water where we’re billed every other month, so it’s just a matter of staying top of it.

If you’re starting a budget for the very first time, I’ve found that taking the time to note every single monthly expense on a separate piece of paper (whether it’s paper, a spreadsheet, whatever) really helps in getting a birds-eye view before putting it in to your budget. Jennifer over at iHeart Organizing has a handy Monthly Finance Checklist that I’ve used a couple of times to lay everything out.

3. Make sure the rest of our money is assigned.

After getting all the must-haves taken care of, we finish budgeting the rest making sure every single dollar is accounted for. This is where it gets divvied up into lifestyle expenses and/or debt (we’re debt free so the debt part doesn’t apply to us).

4. Total everything up to get to zero.

If we add up everything we budgeted and subtract it from our number in step 1 we should come out to zero. The goal is to be at zero, not over and definitely not under. Being at zero means every dollar is accounted for, so you know where your money is going instead of wondering where it went. 🙂

Dave mentions it takes about 90 days to get the hang of budgeting so if you’re trying it for the very first time, don’t get discouraged. Below are some resources that can help if you want to get started with budgeting. Also, if you take the Financial Peace class we go deep into budgeting and the co-coordinators are always there to help.

Resources

- How to Budget Using Simple, Zero-Based Budgeting

- Dave Ramsey’s Guide to Budgeting

- The 4 Things You Must Budget

- 5 Budgeting Myths You May Be Falling For

- EveryDollar – Dave’s FREE Budgeting Tool

*This post is not sponsored by Dave Ramsey or EveryDollar. I’m simply a huge Dave Ramsey fan that believes what he teaches works; my hubs and I not only support his principles, but we co-coordinate Financial Peace University at our church. #nerdlove

You Might Also Want to Read...

Note: This article may contain affiliate links. I only link to products that I know, love, and use. For more info, please view my disclaimers.

JOIN the LIST

Subscribe and stay up to date with the latest blog posts.

JOIN the LIST

Shop My Posts

Want to know where I get #AllTheThings from my blog or Instagram posts? Find what you're looking for below (or just ask).

LIKETOKNOW.IT

Amazon store